Electronic Arts “It’s in the game”

What is EA Sports?

A division of “Electronic Arts”. A global leader in digital interactive entertainment. A leading real-time sports gaming experience providing corporation which ensures Creativity, new and flexible interactive approaches, and excellent Gaming experience for almost 450 million registered players around the globe, And a second-largest gaming company in America and Europe by revenue and market capitalization.

History & About

Electronic Arts Inc. was founded by “Trip Hawkins (American entrepreneur and founder of Electronic Arts)” on May 27, 1982, in San Mateo, California, United States. It is located in Redwood City, California, United States. EA Sports is an American developer and manufacturer of electronic games for personal computers (PCs) and video game consoles.

Electronic Arts have produced large scores of games and some productive software for Personal Computers. In the 1980s Electronic Art became very famous because of its extraordinary work for Amiga ( A home computer which was introduced in 1985). This was a breakthrough for Electronic Arts in the field of animations, sound, and graphics. Afterward, several notable games were produced by EA involving James Bond 007, Everything or Nothing, Titanfall, Need for Speed: Hot Pursuit, Star Wars: The Old Republic, Need for Speed: Hot Pursuit 2, FIFA Soccer 13, The Sims 2. It aims to create a new future for gaming.

Popular EA Games

- Madden NFL 21: A football video game based on the National Football League (NFL). It is an installment of the long-running Madden NFL series. Released on August 28, 2020, and available iOS, Android, Windows, PlayStation 4, Xbox One, Xbox Series X/S, PlayStation 5, and Stadia.

- Star Wars Jedi: Fallen Order: A Third Person Perspective (TPP) action-adventure game on the Star Wars classic story theme. Released on November 15, 2019, and available for Windows, PS4, Xbox One, and Stadia.

- Apex Legends: An online multiplayer free-to-play Battle Royal game. It is among the top-rated and most played games published by EA Sports. Released on February 4, 2019, and available for PlayStation 4, Nintendo Switch, Xbox One, Microsoft Windows.

- FIFA 20: A football simulation game created on Frostbite engine published by Electronic Arts as a part of the FIFA series. Its primary focus is on a new feature titled VOLTA that provides a variance on traditional 11v11 gameplay. Released on September 24, 2019, and available for PlayStation 4, Xbox One, Nintendo Switch, Microsoft Windows.

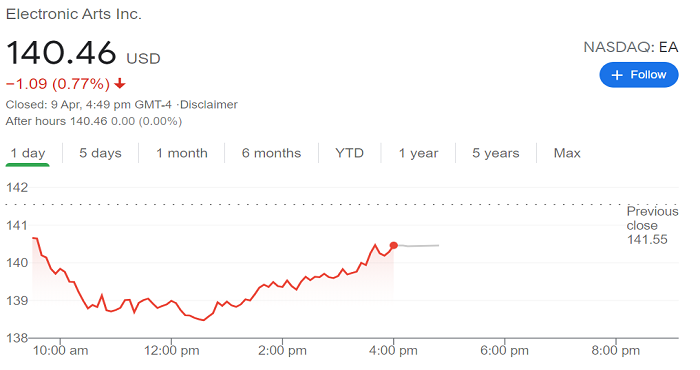

EA sports Stock

After looking into the stats, Electronic Arts Stock (NASDAQ: EA) looks quite attractive at the current levels of $141. We can see that EA stock is up by 26% from the pre-Covid 19 levels of $110 that are slightly greater than the levels of S&P which has moved 21% since its mid-January 2021 levels of around 3,380. It became possible because of the resumption of economic activities as vaccination programs have been initiated and lockdowns are gradually lifted in many countries.

It can be seen that Electronic Arts’ business has gained value during the global pandemic, as people are looking for more forms of entertainment.

EA stock is increased by 66% from levels of around $79 seen at the end of 2018. Given the company’s strong base, some of the 66% rises of the last two years or so are very justified.

As compared to $5.2 billion in 2018, the total revenue of Electronic Arts’ grew from 7.5% and reached $5.5 billion in 2020. The company also maintained its net margins of 26% over the same period, resulting in a 7% growth in net income from $1.3 billion in 2018 to $1.4 billion in 2020.

The total shares of the company suddenly saw a decline of 5%, and with respect to the per-share basis, as compared to $4.25 in 2018, the adjusted earnings grew from 13% and reached $4.81 in 2020. Considering the strong performance over the past few years, Electronic Arts’ P/E multiple also expanded, and it will likely see a more rise from the current positions.

Based on trailing adjusted EPS, Electronic Arts’ P/E multiple expanded from 19x in 2018 to 30x in 2020. While the company’s P/E is at 27x now, led by steady earnings growth, it can also see an expansion in the near term.

Trend

Electronic Arts has benefited from the huge demand for games in 2020 mainly due to the global pandemic situation, and this trend is likely to continue in the future.

There are chances where most of the new player additions during the pandemic are unlikely to leave post-pandemic. Furthermore, EA already owned strong Esports franchises networks, including FIFA, the recent Codemasters acquisition, EA has also added Formula One, and DiRT among others, to its racing games portfolio that earlier included the Need For Speed franchise. In addition to the Codemasters, EA last month announced the acquisition of Glu Mobile (GLUU +0.1% at $2.1 billion).

EA has now gained access to many popular female-centric games with Glu, these games include Kim Kardashian: Hollywood and Covet Fashion, with MLB Tap Sports Baseball, the addition of another sport to the company’s existing portfolio that includes FIFA and Madden NFL among others.

The Glu addition will increase the EA’s mobile business, which currently contributes to just 13% of the total sales.

Electronic Arts will likely see an increase in revenue with the recent additions and with the expansion of its house of offerings. We believe that the company will continue to see steady revenue growth even after the Covid-19 crisis goes down.

Now almost most countries are under control regarding the Covid-19 situation but it provides an overview of how the pandemic has been spreading in the U.S. and contrasts with trends in Brazil and Russia. After examining the valuation, at the current price of $140, Electronic Arts is trading at 36x its estimated adjusted EPS of around $5.56 by the end of 2021, compared to levels of over 25x seen in 2019 and 30x as recently as late 2020, that indicated that there is more room for growth for EA stock, making it a potential economic company worth investing in.

Should you invest in Electronic Arts right now?

After seeing the 10 best stocks for investors to buy right now, Electronic Arts wasn’t on the list. However, the company will see steady revenue growth in the coming years but investing in Electronic Arts is currently not the best option, while there are better options.

With the steady earnings growth going forward, and expansion of the EA’s mobile offerings, the P/E multiple will likely raise more.

As such, we believe that EA stock can be a decent buying opportunity at the current level of $140.

Summing up for you!

Electronic Arts Inc. develops, markets, publishes and distributes games, content, and services that can be played by consumers on a range of platforms, which include consoles, personal computers (PCs), mobile phones, and tablets.

The Company’s games and services are based on a portfolio of intellectual property that includes established brands, such as FIFA, Madden NFL, Star Wars, Battlefield, The Sims, and Need for Speed.

The Company markets and sells its games and services through retail channels and digital distribution channels. The Company’s PC games and additional content can be downloaded directly through its Origin online platform, as well as through third-party online download stores.

Its mobile, tablet, and PC free-to-download games and additional content are available through third-party application storefronts, such as the Apple Application Store and Google