Leading up to the pandemic, the U.S housing market showed remarkable resilience and 2020 was on pace to be the strongest year since the Great Recession.

Home sales at the start of 2020 reached the highest level since 2008.

Strong employment and income growth along with low mortgage rates were the main reason for the strength of the housing market.

COVID-19 Changed Everything

And then the pandemic hit.

In the wake of former U.S. president Trump’s March 13 national emergency declaration, most housing market indicators took a turn straightaway.

Americans were advised to stay home and the home-buying market came to a screeching halt.

Pending sales fell by 40 percent by mid-April. New for-sale listings followed a similar trend and quickly started declining.

At the time, it appeared the housing market was poised for a downturn.

Home Prices Still Stable

While the pandemic severely affected home-buying activity, home price growth has shown relative stability.

The reason for this is simple. Just before the pandemic, there was a scarcity of homes for sale and historically favorable mortgage interest rates enticed many first-time home buyers.

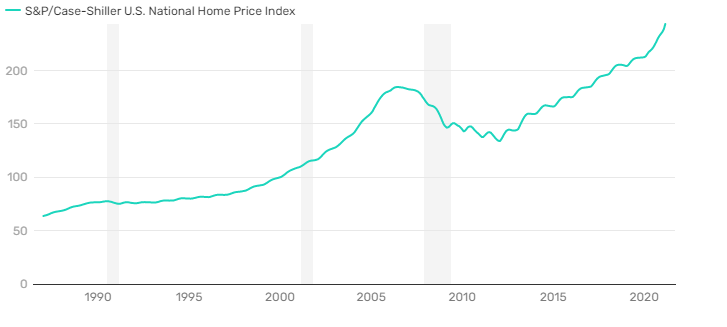

Source: S&P Dow Jones Indices

Despite the housing market cementing its position as one of the most vibrant corners of the pandemic-era economy, a new survey by LendingTree Inc. finds more than half of Americans believe the steady home prices will fall either this year or next year.

The idea that a stable price is a bubble that would burst seems unlikely. The mortgage market is healthier than it was prior to the 2008 financial crisis.

Also, the U.S government has in place interventions like foreclosure and eviction moratorium that are meant to protect homeowners.

The Impact of Local Economies

COVID-19 epicenters such as New York, Philadelphia and Los Angeles have witnessed a decline in mortgage application activity.

Diversification of local economies will play a vital role in the nation’s ability to bounce back going forward.

Industries such as Education, Retail, Personal Services, Leisure and Entertainment have suffered the largest losses due to the pandemic. Affected industries may be forced to permanently change their operations.

This will significantly affect the local economies and the people employed in those sectors. As the economy opens and more Americans are vaccinated, local economies could see a rebirth.

Speculations are high that once the U.S. has made it through the pandemic, households will relocate to areas with more open space and away from high-rise residential areas and high-density central business districts.

The adaptation to working from home may lead to a demand for bigger homes that include a separate office.

Is The U.S. Housing Market Heading For A Crash?

A real estate market crash or collapse typically follows a steep increase in prices.

Strong demand for homes causes this price growth. Builders and developers ramp up production to meet the demand. At some point, demand starts to drop while supply is still going up, leading to a steep drop in home values.

The current rapid upsurge in house values may spark memories of the market conditions that preceded the Great Recession.

Such is the concern that in April, Google searches for “housing bubble” and “when is the housing market going to crash?” reached their peak point in nearly 3 years. Americans want to know why the housing market is so hot and the reason for rising home prices.

These concerns are certainly understandable as the last housing boom triggered a global economic meltdown. But housing experts reassure Americans that they don’t need to get themselves too worked up — yet.

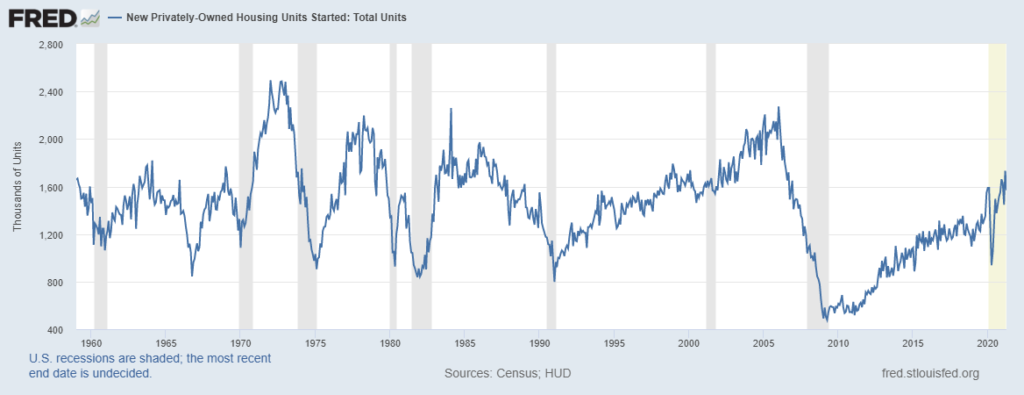

Prior to the Great Recession, there was a glut of housing inventory. At the same time, construction was booming, leading to extra supply.

That’s not where we are right now. Not even close.

Unlike the loose credit standards in 2004-5, the demand for buying homes today is currently driven by vetted homebuyers locking in traditional, fixed-rate mortgages.

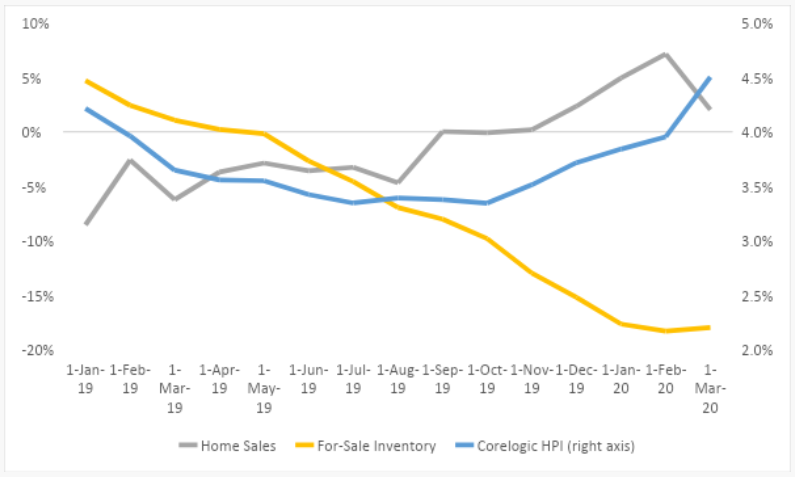

According to the most recent CoreLogic Home Price Insights (HPI®) Report, scarcity of homes for sale (particularly in affordably priced homes) bolstered home price growth, which hit a 4.5 percent year-over-year increase through March 2020.

Source: CoreLogic Home Price Insights (HPI®) Report

Banks and mortgage lenders have very different lending practices compared to the previous housing boom. They offer loans to borrowers with higher credit scores.

All these measures are proof that the demand witnessed in the housing market today is much more organic.

The demand brought by competitive mortgage rates and Millennials’ desire to own homes also triggers a homebuilding boom.

It is, however, unlikely to meet the market needs due to a decade of slow growth in home construction.

Source: fred.stlouisfed.org

We currently have too little supply relative to demand. According to the Urban Institute, there were only 2.5 months of supply left of housing by the end of 2020.

Conditions That Could Cause A Housing Market Crash

The best way to predict a housing market crash is to look for the following warning signs.

- Increase of unregulated mortgages

- Asset bubble bursts

- Inverted yield curve

- Rapidly rising interest rates

- Change to the federal tax code

- Greater number of house flippers

- Return to risky derivatives

- Fewer affordable homes

- Warnings from officials

- Rising sea levels

While some of these have happened, many haven’t. If all of them occur in a rapid fashion, then a crash is more likely.

Housing Market Expected to Stay Hot

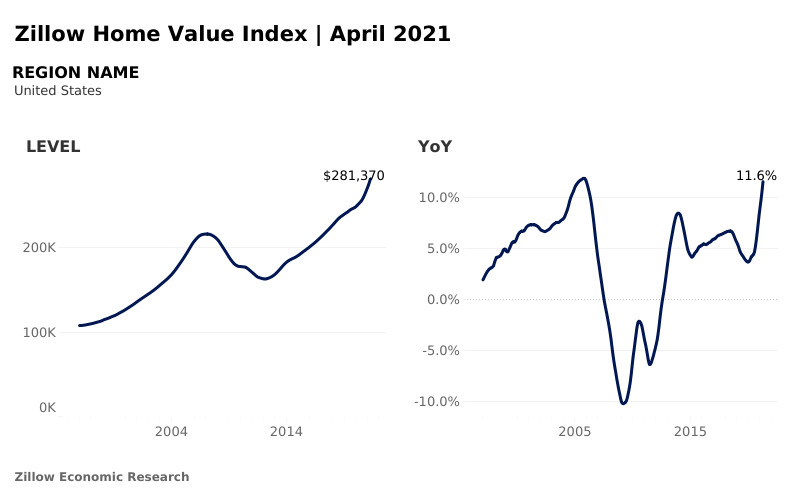

According to Zillow’s latest Market Report, constant demand and low supply are the drivers of a record-breaking upsurge in home values over the past year.

The typical U.S. home value scaled to $281,370 in April 2021, up 11.6 percent in the last 12 months (the highest since 2006).

Source: Zillow April 2021 Market Report

A price collapse in the future is highly unlikely. Current housing market trends simply don’t support that kind of scenario.

Take Mortgage delinquencies, for instance. Cases of homeowners falling behind on their monthly payments have dropped month after month since August 2020.

As distressing and economically detrimental as the pandemic has been, the United States economy will bounce back—and help sustain the recently reinvigorated housing market.

Fannie Mae estimates GDP growth to be approximately 7 percent in 2021, with continued growth expected in 2022 and 2023.

Many economists and housing market analysts predict a continued rise in home prices through 2022, albeit slower than in 2020 and early 2021. As long as new buyers continue entering the market and there is constant demand, the market should stay healthy.

A new long-term housing boom is upon us!